September 3, 2015

AUSTRALIAN Wool Innovation, which funds research and marketing

on behalf of woolgrowers, has recommended that members vote in ‘WoolPoll’ for a two per cent levy for the next

three years.

However, some Western District woolgrowers want the AWI to reduce its funding for marketing activities or change its approach to promoting Australian wool around the

world.

A two per cent levy brought in about $43 million to AWI from woolgrowers in 2013/2014, which was combined with $8.7m from brand licensing and $13m in government contributions.

AWI has previously spent 40 per cent of its funding on research and development (R&D), which has occurred both on and off farms, and 60 per cent on marketing.

AWI chief executive Stuart McCullough confirmed last week that this spending ratio will continue.

Woolgrowers who have paid a levy will be given the chance over the next six weeks to vote on how much of their sales go towards AWI, with options ranging from zero to three per cent.

Hensley Park Jigsaw Farms principal and manager Mark Wootton said he would vote to cut AWI’s funding and he believed many other local growers would do the same.

“I’m a zero (levy) man now,” he said.

“South-west Victorian growers aren’t getting much from AWI; it’s a very NSW-centric organisation.

“I’m convinced about the

R&D, but I’m not sure if

the marketing has been

successful.”

Report

Mr McCullough said the two per cent level was put forward because that was the maximum level the Government would match, and there were also concerns about the global economy.

AWI has commissioned Deloitte to produce an independent report into “all aspects” of its organisation and had found the levy offered “excellent return on investment”.

“What they found is that the company in the last three years improved productivity, we also created some demand for wool and increased wool prices, and we delivered cost savings as well,” Mr McCullough said.

“What they also said is for every $1 spent, $2.90 was

returned to woolgrowers.”

AWI had been “very successful” in promoting wool as a ‘technical’ fibre for the ‘sports and outdoor’ market, as well as re-establishing the luxury market in China.

“The recommendation is two per cent (for the levy). The rationale for that is, firstly, the cost/benefit analysis that has been done by Deloitte indicated that we are doing OK, we are doing well,” Mr McCullough said.

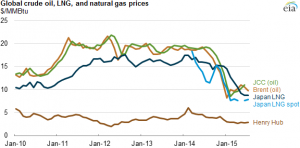

“(At the time of assessment) Greece looked like defaulting on loans, America was still emerging, and China looked a little bumpy. And it has proved to be really bumpy with growth there, although promised at seven per cent, it’s going to be half that.

“We are of the view that consumer confidence is not going to be great over the next three years and now is the time to ratchet up.”

Call for changes

Despite the results presented by Mr McCullough, a number of Western District woolgrowers have called for changes to be made to AWI’s approach to marketing, as well as its transparency with the results of WoolPoll and feedback from its brand campaigns.

Mr McCullough was asked during the WoolPoll launch event in Melbourne last week about the lack of WoolPoll ‘roadshow events’ in the Western District.

“Are you afraid of what

some of the farmers might

say to you?” a woolgrower

asked.

Mr McCullough dismissed that suggestion, but it appears some local woolgrowers have concerns and want better communication with AWI.

“There’s a lack of transparency, I’ve asked them about their marketing campaigns and they’ve said it can’t be judged easily; I wouldn’t be able to run my business like that,” Mr Wootton said.

“I’m sure a lot of SW Vic growers would have voted for zero last time. AWI must have that voting data but they won’t release it.

“There’s a lot of frustration as the wool industry has changed, but I’m not sure AWI has.”

Concerns

Nareeb Nareeb Station property manager and stud principal Richard Beggs said “overall I’m pretty happy with AWI” but he had concerns.

“I support the two per cent levy. I wish that AWI would offer growers a way to vote on how the levy was spent,” he said.

“I would like to see a higher percentage spent on research and on farm innovation rather than marketing

“A lot of growers feel that the spending has shifted too far towards marketing.

I’m a little disappointed in the WoolPoll committee that they didn’t give us that option.”

As AWI has recognised, many woolgrowers are looking at their returns and being tempted to switch to producing crops or other livestock.

‘Glenholme’ woolgrower Matthew Linke said he was questioning the two per cent levy recommendation.

“We’re not seeing the return with auction prices. There’s a fair value for 21 microns but with 16-17 microns it’s getting hard to meet costs,” he said.

“We want to go with a contract rather than go to auction.

“I can’t see the benefits of AWI flowing through to growers if they are producing super fine.”

Mr Linke also said that he found AWI’s approach to marketing “concerning” and he had spoken to wool buyers who shared the same opinion.

Money was also a big concern for Mr Wootton.

“Two per cent is a lot of money … I’m not going to say how much but it’s a fair motza,” he said.

“This is a real life decision and we have got other options.

“Cattle is an option for us, or prime lamb. Right now, protein is king.”